Free Cash Flow (FCF) is a financial metric that indicates the cash a company generates after accounting for operational expenses and investments in capital assets.

It reflects the money available to repay creditors, distribute dividends, and invest in growth opportunities, making it a vital measure of financial health.

Unlike earnings or net income, FCF provides a more comprehensive view by incorporating capital expenditures and changes in working capital, offering insights into a company’s real profitability.

Importance of Free Cash Flow

Free cash flow serves as a critical indicator of a company’s financial stability and operational efficiency. It helps investors and management assess whether the company generates enough cash to fund its obligations and reinvest in its growth.

For lenders, FCF signals the company’s ability to manage debt, while for shareholders, it highlights the potential for consistent dividend payments.

For instance, a company may report stable earnings, but declining FCF can uncover underlying issues like rising inventories, slower customer payments, or stricter vendor terms.

Analyzing FCF trends can offer early warnings about financial challenges that might not appear in the income statement.

How Is Free Cash Flow Calculated?

There are two primary approaches to calculating FCF, depending on the available financial data:

Using Cash Flow from Operating Activities

Begin with the cash flows from operating activities, then subtract capital expenditures. Adjustments for interest expenses and tax effects can be included for specific analyses. Formula:

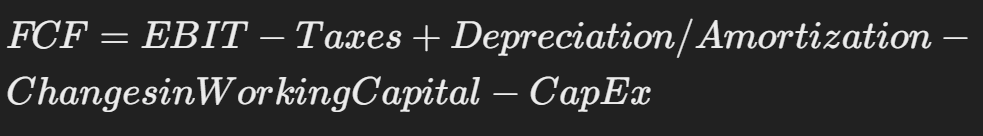

Using Earnings Before Interest and Taxes (EBIT)

Start with EBIT, then account for taxes, non-cash expenses like depreciation and amortization, changes in working capital, and capital expenditures. Formula:

Benefits of Analyzing Free Cash Flow

Free cash flow provides several advantages over traditional profitability metrics:

- Comprehensive Analysis: FCF reflects changes in working capital, providing insights into cash inflows and outflows not visible in the income statement.

- Early Problem Detection: Declining FCF trends may reveal financial weaknesses, such as inventory mismanagement or credit issues.

- Shareholder Insights: By excluding non-cash items, FCF offers a realistic view of funds available for dividend payouts or reinvestment.

- Debt Assessment: Lenders rely on FCF to evaluate a company’s ability to meet its obligations and sustain additional debt.

Practical Applications of Free Cash Flow

Investment Analysis

Investment professionals often analyze FCF trends over time to assess risk and potential returns. Stable or growing FCF trends generally indicate a lower risk of financial disruptions.

In contrast, falling FCF can signal challenges even when other metrics like earnings and revenue appear strong.

Capital Allocation

Management uses FCF to make informed decisions about reinvestment, acquisitions, or shareholder distributions. For example, positive FCF might indicate that the company can fund expansion projects without relying on external financing.

Challenges in Interpreting Free Cash Flow

Despite its benefits, FCF has limitations:

- Lumpy Expenditures: Capital investments like equipment purchases can create short-term fluctuations in FCF, complicating trend analysis.

- Depreciation Accounting: FCF reflects cash spent on assets upfront, while depreciation spreads these costs over time, creating discrepancies with other metrics like EBITDA.

- Calculation Complexity: FCF isn’t directly reported in financial statements and requires manual computation, which may discourage some investors from using it.

For example, a company purchasing equipment worth Rs 800,000 might report lower FCF in the purchase year, even if its long-term financial health remains stable. This highlights the need to evaluate FCF alongside other metrics.

Real-World Example

Consider Company XYZ, which reported the following financial data:

| Year | Revenue | EPS | FCF/Share |

|---|---|---|---|

| 2017 | $100 | $1.00 | $0.85 |

| 2018 | $105 | $1.03 | $0.97 |

| 2019 | $120 | $1.15 | $1.07 |

| 2020 | $126 | $1.17 | $1.05 |

| 2021 | $128 | $1.19 | $0.80 |

| TTM | $130 | $1.20 | $0.56 |

Despite increasing revenue and earnings per share, XYZ’s FCF/share declined. This might be due to high capital expenditures, inventory buildup, or changes in payment terms with vendors and customers.

A deeper dive into working capital changes could reveal whether XYZ is investing in growth or facing operational inefficiencies.

Considerations

- Positive vs. Negative FCF: A positive FCF indicates available cash for reinvestment or shareholder returns, but it’s essential to consider the source. For instance, cutting CapEx to inflate FCF may harm long-term growth.

- Trends Over Absolute Values: Analyzing the trajectory of FCF provides more insight than focusing on a single year’s figure.

Free Cash Flow offers a comprehensive view of a company’s financial health, helping investors and stakeholders make informed decisions.

While FCF has its limitations, evaluating its trends alongside other financial indicators can provide valuable insights into a company’s operational efficiency, profitability, and long-term viability.

Disclaimer – This article is intended for informational purposes only and should not be construed as financial advice or a recommendation to buy, sell, or hold any securities. The content provided is based on publicly available information and standard financial metrics, and while every effort has been made to ensure accuracy, errors or omissions may occur. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions. The publisher is not responsible for any financial losses or decisions made based on the information provided in this article.